Thirty new drugs have been approved by the US FDA in 2011 for marketing in the United States. This list includes novel new drugs, known as new molecular entities (NMEs), biologics and new indications for drugs already approved. Eleven of the thirty NMEs were new drugs approved for orphan diseases, while twelve are considered first-in-class drugs with a unique new mechanism of action. During 2011, the US FDA approved many unique and new drugs for chronic obstructive pulmonary disease, deep vein thrombosis, systemic lupus erythematosus (SLE), and epilepsy. In addition, several new biologicals were approved in the past year for the treatment of macular degeneration, acute lymphoblastic leukemia, Hodgkin lymphoma, melanoma, chronic hepatitis C, and SLE. The introduction of thirty NMEs in 2011 underscores a robust success rate. It confirms that innovation is once again beginning to pay off. Analysis of drug approvals reveals a unique new trend in drug discovery in the face of stiff competition from generic products and declining revenues. In the existing climate of reduced pipeline for NMEs, the future and survival of big companies rests heavily on their unique niche products and biologics with relatively less competition from generic manufacturers. However, the competition for biosimilars is growing by the hour and therefore, crafting innovative generic biologicals is vital for generic biotechnology companies. Although the number of NMEs approved in the past 10 years has been declining, there is a substantial increase in R&D expenditure for drug discovery. Overall, the new drug approval list unveils unique and emerging trends in drug discovery especially in the current generics era.

New drugs approval declined substantially during the past few years

New drugs are desperately needed for cancer, infectious diseases, neurological disorders and life-style conditions. The number of new drugs approved by the US FDA has declined substantially during the past few years, despite large increases in R&D investment for drug discovery and development. There is growing 'pipeline syndrome' for new drugs, while success is very limited for 'blockbuster' drugs with sales of over $1 billion. The pharma industry in the US has been scaled back. Many pharma and biotech companies are changing how they fill their new drug pipelines. In recent years they have trimmed their early discovery efforts and focused their resources on processes further downstream. New drug development begins with the identification of molecular targets that play a central role in a particular disease state. One key goal is the identification of an appropriate ligand that binds to a therapeutically relevant biological target. Four different strategies used to identify new lead candidates include phenotype screening, mechanistic or target-based screening, modification of natural agents and biologic-based approaches. Drug discovery is a tedious and difficult process and it takes about 5 to 10 years to introduce a new drug. It costs an estimated $1 billion for a new drug discovery. The failure of drug development or approval costs up to 80% of total R&D investment, typically from $100 to $700 million. Therefore, new drug discovery and development is a high-risk and high-reward business.

In 2011, the US FDA approved many new and unique drugs for marketing in the United States. The new drug therapies were approved for chronic obstructive pulmonary disease (COPD), deep vein thrombosis (DVT), systemic lupus erythematosus (SLE), and epilepsy. In addition, a number of new biologicals were approved in the past year for infectious diseases and cancer therapy.

This article provides a brief overview of the new drugs approved in 2011. The drug list contained in this article comprises of the current FDA-approved indications, pharmacology and related mechanistic information. Due to space constraints, an in-depth review of new drugs including clinical pharmacology, dosing guidelines, and adverse effects are beyond the scope of this article. This pharmaceutical update is designed to focus attention on the growing trends in the new drugs and biologics approvals that may shed unique or emerging trends in drug discovery patterns. The 2011 novel new drugs brochure published by the Center for Drug Evaluation and Research (CDER) provides a broad overview of FDA approvals of new molecular entities for the calendar year 2011 (CDER, 2012). Sixteen of the 30 NMEs approved in 2011 have been reviewed in detail elsewhere (Mancano, 2012a; 2012b).

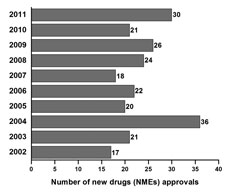

Fig.

1. The

NMEs approvals during the past 10 years in the United States.

Trends in new NMEs, biologicsIn 2011, the US FDA approved many unique and new drugs for COPD, DVT SLE, and epilepsy. In addition, several new biologicals were approved in the past year for treatment of macular degeneration, acute lymphoblastic leukemia, Hodgkin lymphoma, melanoma, chronic hepatitis C, and SLE. Category-wise analysis indicate that eleven of the 30 NMEs were new drugs approved for orphan diseases, while twelve are considered first-in-class drugs. It is expected that these new drugs would bring substantial improvements in healthcare of many patients. The US FDA has approved over 30 new drugs for marketing in the United States. This list includes novel new drugs, known as NMEs, biologics and new indications for drugs already approved.

Tracks for expediting new drug review and approvalThe US FDA has various tracks for expediting new drug review and approval for marketing, including priority review, fast track and accelerated approval. Twelve of the 30 NMEs approved in 2011 are considered first-in-class, referring to drugs which use a new a unique mechanism of action for treatment of the health condition (CDER, 2012). Fast track status is considered if the product is intended for treatment of a serious or life-threatening condition and addresses an unmet medical need.

There are several high-impact milestones in 2011. The foremost first-in-class product of 2011 is belimumab (Benlysta), the first new drug approved to treat SLE in over 50 years. SLE is a serious and potentially fatal autoimmune disease that attacks healthy tissues, including the joints, skin, kidneys, lungs, heart, and brain. SLE flare-ups are treated with NSAIDs, corticosteroids, immunosuppressants, and antimalarials. These agents are not very effective in many patients. It is hoped that belimumab may offer a better alternative for the treatment of SLE. Another noteworthy new drug is brentuximab vedotin (Adcetris), the first new drug to treat Hodgkin Lymphoma in over 30 years. Lingagliptin (Tradjenta), an antidiabetic agent, is another major drug approved in 2011. It belongs to the gliptin class that affects endogenous incretin hormones involved in regulation of glucose homeostasis. Like sitagliptin, lingagliptin is a potent inhibitor of dipeptidyl peptidase-4 enzyme, which inactivates the incretins.

New drugs of 2011 include two new treatments for hepatitis C (telaprevir and boceprevir). Several anticancer drugs were introduced in 2011 including crizotinib, brentuximab, abiratirone, and vandetanib. Two new drugs--roflumilast (Daliresp) and indacaterol (Arcapta Neohaler)--have been approved for COPD characterized by the occurrence of chronic bronchitis or emphysema that leads to dyspnea. In the antibiotics field, fidaxomicin (Dificid) has been approved for the treatment of Clostridium difficile-associated diarrhea.

Ablifercept (Eylea) is another important new drug of 2011 approved for preventing vision loss from macular degeneration. Ticagrelor (Brilinta) is a cardiovascular agent approved for preventing heart attack. Belatacept (Nulojix) is a new treatment to prevent kidney transplant rejection. Vilazodone hydrochloride (Viibryd), a SSRI type antidepressant similar to those of citalopram, escitalopram, fluvoxamine, paroxetine, and sertraline, was approved in 2011 for major depressive disorder (Hussar, 2011). Two high-profile drugs from big pharma companies in 2011 include ipilimumab (Yervoy, BMS) for melanoma and ticagrelor (Brilinta, AstraZeneca) for cardiovascular conditions.

In 2011, two new antiepileptics (ezogabine and clobazam) were approved for the treatment of epilepsy, a common neurological disorder characterized by the repeated occurrence of seizures. The list of antiepileptics has expanded with the addition of these two new drugs. Despite the availability of over two dozen antiepileptics, many patients (up to 30%) exhibit seizures that are intractable to current drug therapy.

For patients with acute lymphoblastic leukemia (ALL), who have developed an allergy (hypersensitivity) to E. coli derived asparaginase and pegapargase chemotherapy drugs used to treat acute lymphoblastic leukemia. Intrvitreal injection It is an enzyme that catalyzes the hydrolysis of asparagine to aspartic acid and thus deprives the leukemic cell of circulating asparagine. Leukemic cells are unable to synthesize asparagine.

Certain patients with late-stage (locally advanced or metastatic), non-small cell lung cancers who express the abnormal anaplastic lymphoma kinase gene.

ConclusionNew drug development and approval has several hurdles. The main hurdle is to demonstrate superior therapeutic efficacy of the new drug without undue adverse effects that affects the patient’s quality of life. Novel drug approval appears to remain steady or decline during the past decade (Figure 1). In the 10-year period between 2002 and 2011, the FDA approved 235 NMEs including one-third first-in-class drugs (Swinney and Anthony, 2011; CDER, 2012). Thirty NMEs were approved in 2011, representing the second highest total in the past ten years. In 2004, there were 36 NMEs approved, the highest in the past ten years. Analysis of the trends during the past 10 years suggests an average 24 NME approvals per year. However, the overall number of NMEs approved over the past 10 years has not been encouraging, with declining trends. While harsh economic econditions continue to force large parmaceutical companies and biotech firms to focus on the bottom line and scale back R&D budgets, the new drugs of 2011 would certainly represent a turnaround to some companies pursuing high-risk, high-reward drug development programs.

Research innovation is once gain beginning to pay off. Introduction of 30 NMEs in 2001 underscores a robust success rate relative to the past seven years. The drug approvals in 2011 reveal a unique new trend in drug discovery in the face of stiff competition from generic products and declining revenues. In the existing climate of reduced pipeline for NMEs, the future and survival of big companies rests heavily on their unique niche products and biologics with relatively less competition from generic manufacturers. Drug repositioning or new indication (e.g. gabapentin for restless legs syndrome) is a strategy focusing on new indications not necessarily related to the original disease focus. However, the competition for biosimilars is growing by the hour and therefore, crafting innovative generic biologicals is vital for generic biotech companies. Nevertheless, the new drug approval list unveils unique and emerging trends in drug discovery especially in the current generics era.

There is huge decline in pharmaceutical R&D efficiency (Scannell et al., 2012). Despite the large investments made in drug discovery in the past decade, there is still a dearth of new blockbuster drugs with annual sales of over $1 billion. This highlights the persistence of a model of drug development that has not adapted to changes in science or the marketplace. The phenotype screening model is escalating in cost due to lack of mechanistic rationale. The strategy of merger, pursued by many companies to compensate for the failure to develop new drugs, has compounded the problem on an already inefficient process. This reduced effort reflects rather a change in business model. The productivity decline is scary and reversing it will be important to the big pharma’s survival (Scannel et al., 2012). However, there are unique trends that are emerging to drive the current new drug discovery.

The two issues impacting on the revenue from innovative brands include patent cliff and generics pressure. There are new opportunities to address the current challenges in this field. Major obstacles can be successfully overcome by adapting a “mechanism-based” (target-based) drug discovery that may reduce costs and accelerate drug development (Reddy and Woodward, 2004). Selection of a reliable target is vital for the success of this strategy (Mullard, 2011). In the United States, academic institutes and the NIH have been scaling up early drug discovery efforts. Armed with new ideas, targets and magnificent capabilities, they are now able to take projects much beyond target identification and optimize compounds that “chemically validate” a target and thereby jump-start the process of translational research. As new partnerships between academia and industry are established, institutes armed with high-throughput translational research are well-placed to play a central role in the newly emerging model for drug discovery and biomarker research.

(The author is Editor-in-Chief, International Journal of Pharmaceutical Sciences and Nanotechnology, and associate prof, Dept of Neuroscience and Experimental Therapeutics, Texas A&M University System Health Science Center, College of Medicine, Bryan, Texas, USA).